What can a middle-class home buyer afford across Canada?

By Penelope Graham on Dec 09, 2019

It doesn’t matter what time of year – housing affordability is a constant point of concern for Canadians. According to the latest data from the Canadian Real Estate Association, the average residential home will now set prospective home buyers back $525,000, though affordability challenges are much more acute in the nation’s priciest markets, pushing the $1 million mark in Toronto and Vancouver.

Home prices forecasted to rise in 2020

There are a number of factors contributing to rising home prices; strong immigration and property investment are certainly an aspect, as are the record-low interest rates available today, which make it cheaper to get a mortgage. There’s also mounting evidence that home buyers have largely recovered from the national mortgage stress test put in place at the beginning of 2018, and are returning to the market with greater purchasing power. That will push the national average up by 2.1% in 2020, according to CREA.What is middle-class affordability like across Canada?

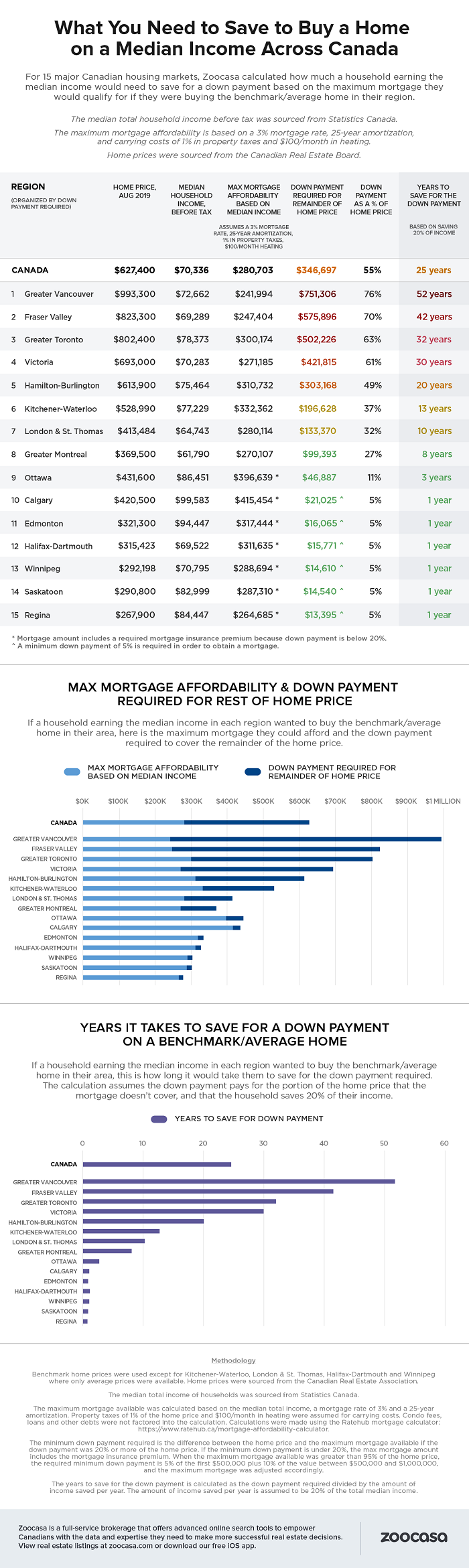

With all these factors in mind, just how feasible has it become for a middle-class home buyer to afford real estate in their local market?To find out, Zoocasa conducted a study of 15 major urban centres across Canada, using benchmark home prices in each, as well as local median incomes as reported by Statistics Canada, which were used to calculate the maximum mortgage amount such a household would qualify for in each city. The study then determined whether that mortgage amount would be sufficient to purchase the benchmark-priced home in that city and if not, how much of an additional down payment the buyer would need to save in order to close the deal.

Finally, it also calculated the timeline it would take to save those funds, assuming households set aside 20% of their incomes annually. To determine the mortgage amount, it was assumed borrowers qualified for a 3% interest rate, and had a 25-year amortization. One percent of the home’s value was factored in for property taxes, as well as $100 per month for heating bills.

Affordability best in prairie cities

According to the findings, there are a total of eight markets where a household would be able to save the necessary down payment for a home purchase in less than a decade. However, in the most expensive markets, doing so would take close to half a century, clocking in at 52 years in Vancouver, 42 years in the Fraser Valley, and 32 years in Greater Toronto.Perhaps not surprisingly, affordability was best in the Prairie provinces, which account for five of the most affordable markets, including Regina, Saskatoon, and Winnipeg. As the benchmark home prices in each of these cities remains below the $300,000 mark, home buyers with a median income would qualify for a large enough mortgage and would be able to buy a benchmark home with just a 5% down payment, which would take them a year to save.

Another comparably affordable locale is the Ottawa real estate market, which CREA has identified as one of the fastest-heating in the nation due to its family-friendly neighbourhoods and strong job market. There, a benchmark-priced home comes in at $431,600; a household earning the median income would qualify for a mortgage of $396,639. That leaves them with a $46,887 shortfall, which can be saved for within a three-year timeline.

Not much available for middle-class buyers in Greater Golden Horseshoe

The Greater Montreal housing market could potentially be an option for buyers looking for a more affordable entry point to the market, with a benchmark home price of $369,500, though median-income buyers would be required to come up with a down payment of $99,393, which would take roughly eight years to save for. However, the study found that several of the secondary Greater Golden Horseshoe markets, which include London & St. Thomas, Kitchener-Waterloo, and Hamilton-Burlington, would require savings timelines between 10 – 20 years, as benchmark home prices reach the mid $400,000 - $600,000 range.Check out how housing affordability differs for median-income households in the infographic below:

Penelope Graham is the Managing Editor at Zoocasa, a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings, including homes for sale in London, Ontario, Toronto, and Hamilton, at zoocasa.com or download our free iOS app.