How do condo ownership costs compare to rents in Toronto? STUDY

By Penelope Graham on Nov 15, 2019

The cost of rental housing never ceases to be a hot-button issue in Toronto, and no wonder – with a city-wide vacancy rate of 1.1%, the 416 has one of the tightest rental markets in North America. As well, rents keep steadily rising; the latest third quarter report from the Toronto Real Estate Board reveals that the average one-bedroom will now set tenants back nearly $2,300, while a two-bedroom unit is nearly $3,000.

Is it possible to save while renting?

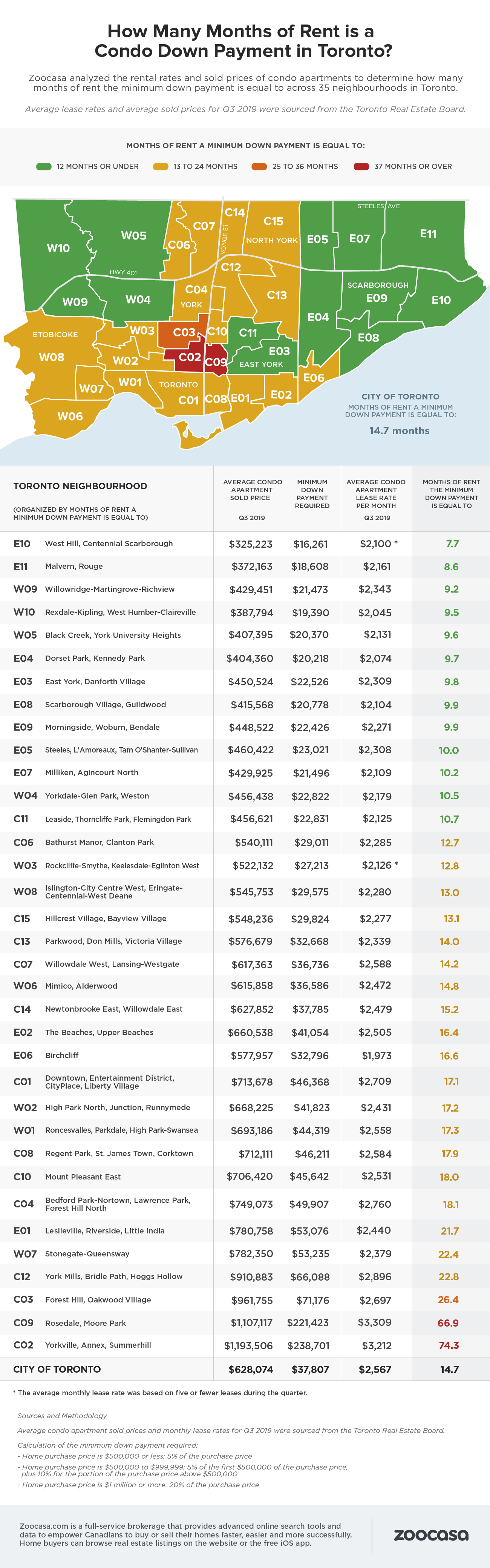

With this in mind, just how feasible is it for those currently renting to make the jump onto the property ladder? To find out, Zoocasa sourced average rents for rental condo apartments in 35 neighbourhoods across Toronto, as well as the average unit sale prices for condos. The study also calculated the minimum down payment to purchase a unit in each neighbourhood, as well as the equivalent number of months of rent. This provides insight into which neighbourhoods have the highest and lowest homeownership-to-rent-cost ratios – essentially, how long it would take to save for a condo down payment if you didn’t need to pay rent.According to the findings, there are a total of 13 neighbourhoods where someone living rent-free would be able to save for a down payment in less than 12 months. These are mostly neighbourhoods located within the eastern and western extremes of the city, far from the core and transit services, and include West Hill Centennial Scarborough, Malvern Rouge, Willowdale, Rexdale Kipling, and East York. What these neighbourhoods all have in common are their underlying affordability – the average price for condo units in each are all under $500,000, with savings timelines between 7.5 – 10.5 months.

Obviously, it’s a different picture at the pricier end of the spectrum; in Yorkville Summerhill, where the average condo unit costs over $1.2 million, savers would be looking at a timeline of over 74 months. In Rosedale Moore Park, where units still broach $1 million, it’s nearly 67 months.

Most Toronto neighbourhoods in 13 – 24 month range

However, the bulk of Toronto neighbourhoods – 19 in total – fall between the 13 – 24-month range. These include very popular neighbourhoods for condos for sale in downtown Toronto such as City Place and Liberty Village; there, the average unit costs $713,000, requiring a savings timeline of 17.3 months. In Leslieville, savers would be looking at a timeline of 21 months, while those looking to buy in Roncesvalles would need to save for 17 months.Check out the infographic below to see how condo ownership and rental costs compare across the City of Toronto:

Penelope Graham is the managing editor at Zoocasa, a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings for the city of Toronto, including condos for sale in North York, Etobicoke, and Scarborough, at zoocasa.com or download our free iOS app.